Commonly referred to as tax-loss harvesting, this strategy can be used to offset realized gains and potentially eliminate any taxes due on sales. Sell positions whose current value is below the purchase price first to realize a loss. If you are subject to high-income tax, it should be more tax-efficient to realize long-term gains than withdraw funds from pre-tax accounts. Note that long-term capital gains tax rates are usually lower than ordinary income tax rates in higher income years. Therefore, it is important to generate the funds for withdrawal as tax-efficiently as possible. However, you could be taxed on any net realized gains, taxable interest income and dividends. Generally, you are not taxed on the money withdrawn from these accounts. These include Roth IRAs (if the five-year and age tests are met), savings and individual or joint investment accounts. Take necessary withdrawals from after-tax asset accounts. In general, we recommend considering the following strategies during high-income periods.

Therefore, we believe it is important to work with your CPA or tax advisor to develop a long-term plan that optimizes your cash flow while minimizing your tax liability. If done poorly, short-term decisions may actually result in higher taxes at a later date. So it’s crucial that you consider when and how the realization of the deferred income will be taxed. With tax bracket management, you usually aren’t eliminating income, but simply deferring income into another period. Regardless of whether tax reform occurs, tax bracket management is still a great tool for helping develop a tax-efficient withdrawal strategy to boost your after-tax returns.

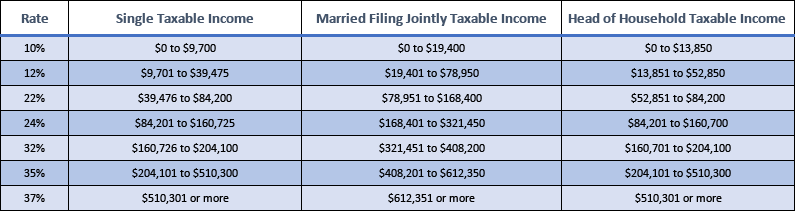

#Current highest tax bracket code#

President Trump has indicated he would like to simplify the tax code and reduce the current seven tax brackets to just three. This is a strategy utilized to reduce taxes in high-income years by possibly realizing additional income in lower income years if you expect to receive higher income in future years.Ĭurrently, there are seven tax brackets (ignoring the alternative minimum tax, net investment income tax, Medicare surtax and long-term capital gain rates).

One of the best ways to increase after-tax returns is to implement tax bracket management. Regardless of whether your investment objective is growth or capital preservation, maximizing your after-tax return should be a primary goal.

0 kommentar(er)

0 kommentar(er)